YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

A soft landing of the economy was a buzz phrase throughout 2023, as businesses and consumers alike managed high interest and inflation rates. Fears of a post-pandemic recession were on the minds of many early in the year, but an economic crash was held at bay with the Federal Reserve steadily increasing interest rates between 2022 and 2023.

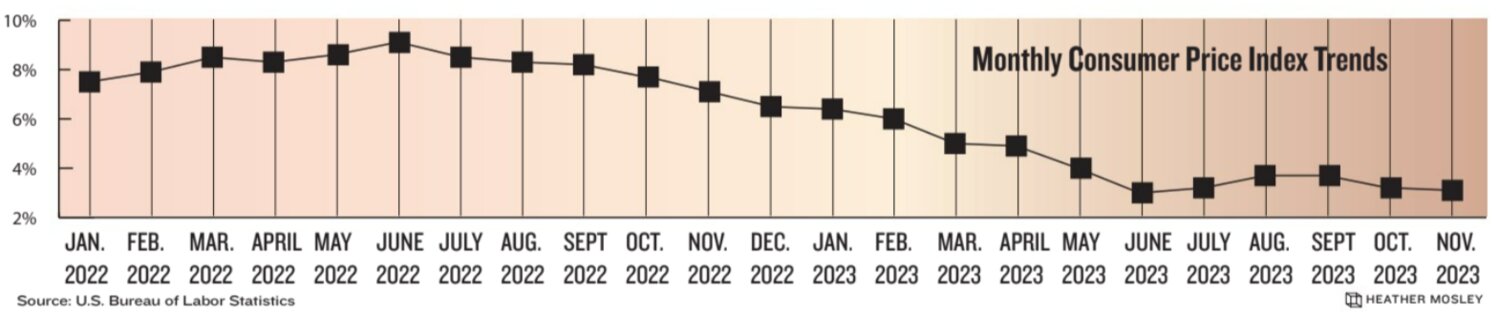

The U.S. inflation rate recorded a recent peak of 9.1% in June 2022, then slowly declined throughout 2023 to settle slightly above 3% in the fourth quarter, according to the Bureau of Labor Statistics.

“Inflation keeps coming down, the labor market keeps getting back into balance, and it’s so far, so good,” Fed Chair Jerome Powell said in a December Associated Press article.

Powell’s commentary came after the monetary policy committee held the federal funds rate steady at a 5.25%-5.5% range for the third straight time during its December meeting. With a target inflation rate of 2%, the Fed is expected to begin cutting interest rates next year.

Economists from the Federal Reserve Bank of St. Louis visited Springfield in August to address the economic activity during the Springfield Area Chamber of Commerce’s annual Economic Outlook event.

“We had, going into this year, a lot of concern about what this year would hold,” economist Nathan Jefferson told the chamber crowd. “By and large, a lot of that concern has been alleviated because consumer demand has been so strong. Now for Springfield, specifically, a lot of that has been services demand.”

A positive point emphasized was gross domestic product growth above 2% in the second quarter – and it only got better as the year went on to a third-quarter estimate of 5.2%, according to the Commerce Department’s latest data.

“As the economic data continues to come in, it’s simply surpassing expectations,” noted economist Kathleen Navin, a colleague of Jefferson’s at the St. Louis Fed.

The federal money policy moves impacted the housing market as borrowers became tepid on acquiring new mortgages.

Existing home sales dropped for five months straight, until a slight uptick of 0.8% in November, compared with the month prior, according to National Association of Realtors data. The Midwest was noted as a region with sales increases.

According to Freddie Mac, the average 30-year, fixed-rate mortgage hovered around 7% the past year.

Housing starts had more promise, however, as homebuilders nationwide ramped up production. According to the NAR, single-family home construction in November rose 18% from the prior month and was up 42% from a year ago.

“Homebuilders’ sales have been up this year despite high mortgage rates due to the offer of incentives on buying down interest rates and the long-held business model of offering co-op commission to buyer agents,” NAR Chief Economist Lawrence Yun said in a statement.

Yun also forecast lower inflation and interest rates in 2024.

Led by a team of gardening experts, Harvest Grow Supply offers know-how alongside more than a thousand products.